maine excise tax refund

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Maines excise tax on cigarettes is ranked 11 out of the 50 states.

Sales Taxes In The United States Wikipedia

For questions about your tax bill please contact the Division of Collection and Treasury.

. FAQ about Coronavirus COVID-19 - Updated 472021. Retail Dealer Gas Shrinkage. As of May 31 2023.

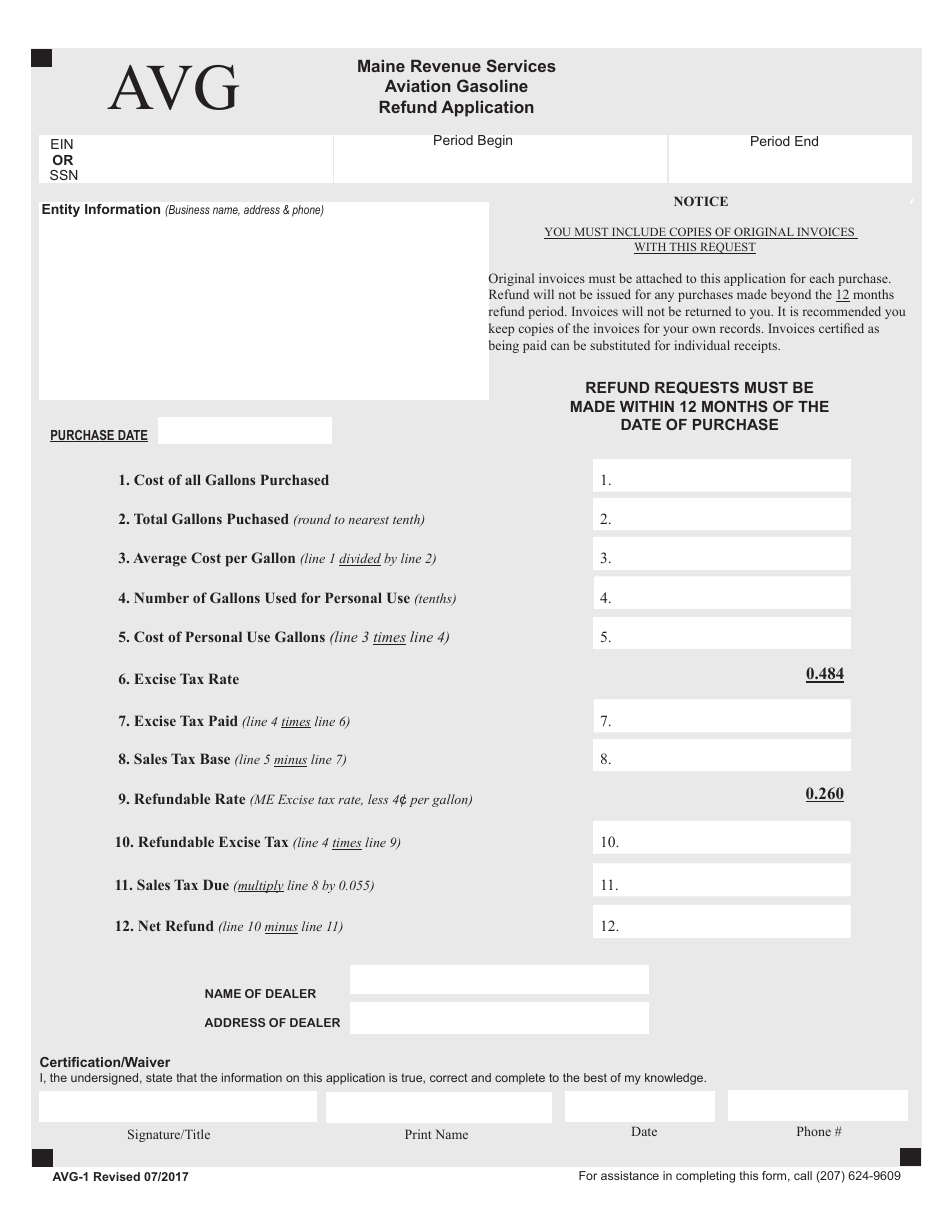

The excise tax due will be 61080. Send us an email to taxpayerassistmainegov with Portal in the subject line. Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund.

The Maine excise tax on cigarettes is 200 per 20 cigarettes higher then 78 of the other 50 states. The purchase price of gasoline and clear diesel generally includes excise tax. If a motor fuel is sold without excise tax the receipt.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. You can also reach us by telephone at 207-624-9784 between the hours of 9 AM and 12 PM. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject. Refund information is updated Tuesday and Friday nights. As of December 1 2022 payments for Sales Use Service Provider Withholding and Pass Through Entity Withholding Taxes can be made via the MTP at.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Maine Revenue Services temporarily limits public access. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the.

The purchase price of gasoline and clear diesel generally includes excise tax. Please enter the primary Social Security number of the return. Maine Watercraft Excise Tax Law - Title 36 Chapter 112.

Excise tax on low-alcohol spirits products and fortified wines. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. Except as provided in subsection 2-A the in-state manufacturer or importing wholesale licensee shall pay an excise tax of 124 per gallon on all low-alcohol spirits products and fortified.

2020 Unemployment Compensation Income Tax Exclusion Instructions. If a motor fuel is sold without excise tax the receipt. How do I know if I paid Maine excise tax on my fuel.

Excise tax is an annual tax that must be paid prior to registering your vehicle. Requests for a refund are semiannual. Any change to your refund information will show the following day.

How do I know if I paid Maine excise tax on my fuel. Sales Use. Excise Tax is an annual tax that must be paid prior to registering a vehicle.

Dates for requesting a refund are January - June for the first half of the year due no later than September 30th and. An excise tax is imposed on the privilege of manufacturing and selling low-alcohol spirits products and fortified wines in the. WHAT IS EXCISE TAX.

A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who. March 2023 Certified Maine. Excise tax is an annual tax that must be paid prior to registering your vehicle.

Maine Form 706me2012 Fill Out Sign Online Dochub

Sales Tax Amnesty Programs By State Sales Tax Institute

Where S My Refund Maine H R Block

Mainers Can Now Check The Status Of 850 Relief Checks Youtube

Form Avg 1 Download Fillable Pdf Or Fill Online Aviation Gasoline Refund Application Maine Templateroller

Former Granite Staters Life S Better Across The Border

Maine Income Tax Does Not Conform To Ffcra And Cares Act

Maine Auto Excise Tax Repeal Question 2 2009 Ballotpedia

Maine Sales Tax On Cars Everything You Need To Know

Maine Cigarette And Tobacco Taxes For 2022

Sales Fuel Amp Special Tax Division Maine Gov

Sales Fuel And Special Tax Division Maine Gov

3 11 3 Individual Income Tax Returns Internal Revenue Service

Maine Military And Veteran Benefits The Official Army Benefits Website

Massachusetts Graduated Income Tax Amendment Details Analysis

Maine Military And Veteran Benefits The Official Army Benefits Website